A Biased View of Pkf Advisory Services

Rumored Buzz on Pkf Advisory Services

Table of ContentsPkf Advisory Services - QuestionsLittle Known Questions About Pkf Advisory Services.An Unbiased View of Pkf Advisory ServicesHow Pkf Advisory Services can Save You Time, Stress, and Money.Not known Incorrect Statements About Pkf Advisory Services

Allow's state you wish to retire in 20 years or send your youngster to an exclusive university in one decade. To complete your goals, you might need a proficient professional with the best licenses to assist make these strategies a reality; this is where a financial consultant comes in. Together, you and your advisor will cover numerous topics, consisting of the amount of cash you ought to save, the sorts of accounts you need, the sort of insurance coverage you ought to have (consisting of long-lasting care, term life, disability, etc), and estate and tax planning.On the survey, you will certainly also indicate future pensions and income sources, job retirement needs, and describe any lasting financial commitments. In other words, you'll detail all existing and expected financial investments, pensions, gifts, and incomes. The spending element of the survey discuss even more subjective topics, such as your risk resistance and danger capacity.

At this factor, you'll also let your consultant recognize your investment preferences. The first assessment might also include an evaluation of various other economic monitoring subjects, such as insurance policy problems and your tax situation. The consultant requires to be familiar with your existing estate plan, as well as various other professionals on your preparation team, such as accounting professionals and attorneys.

7 Easy Facts About Pkf Advisory Services Shown

It will look at practical withdrawal prices in retirement from your profile properties. In addition, if you are married or in a long-term partnership, the plan will certainly think about survivorship issues and economic situations for the making it through partner. After you examine the plan with the advisor and change it as necessary, you're ready for action.

It's crucial for you, as the customer, to understand what your coordinator advises and why. You must not follow an advisor's referrals unquestioningly; it's your cash, and you must recognize just how it's being deployed. Keep a close eye on the costs you are payingboth to your consultant and for any funds purchased for you.

The expert will certainly set up a possession allowance that fits both your risk tolerance and danger capability. Property allotment is simply a rubric to establish what percent of your total monetary profile will be dispersed throughout various asset classes.

Excitement About Pkf Advisory Services

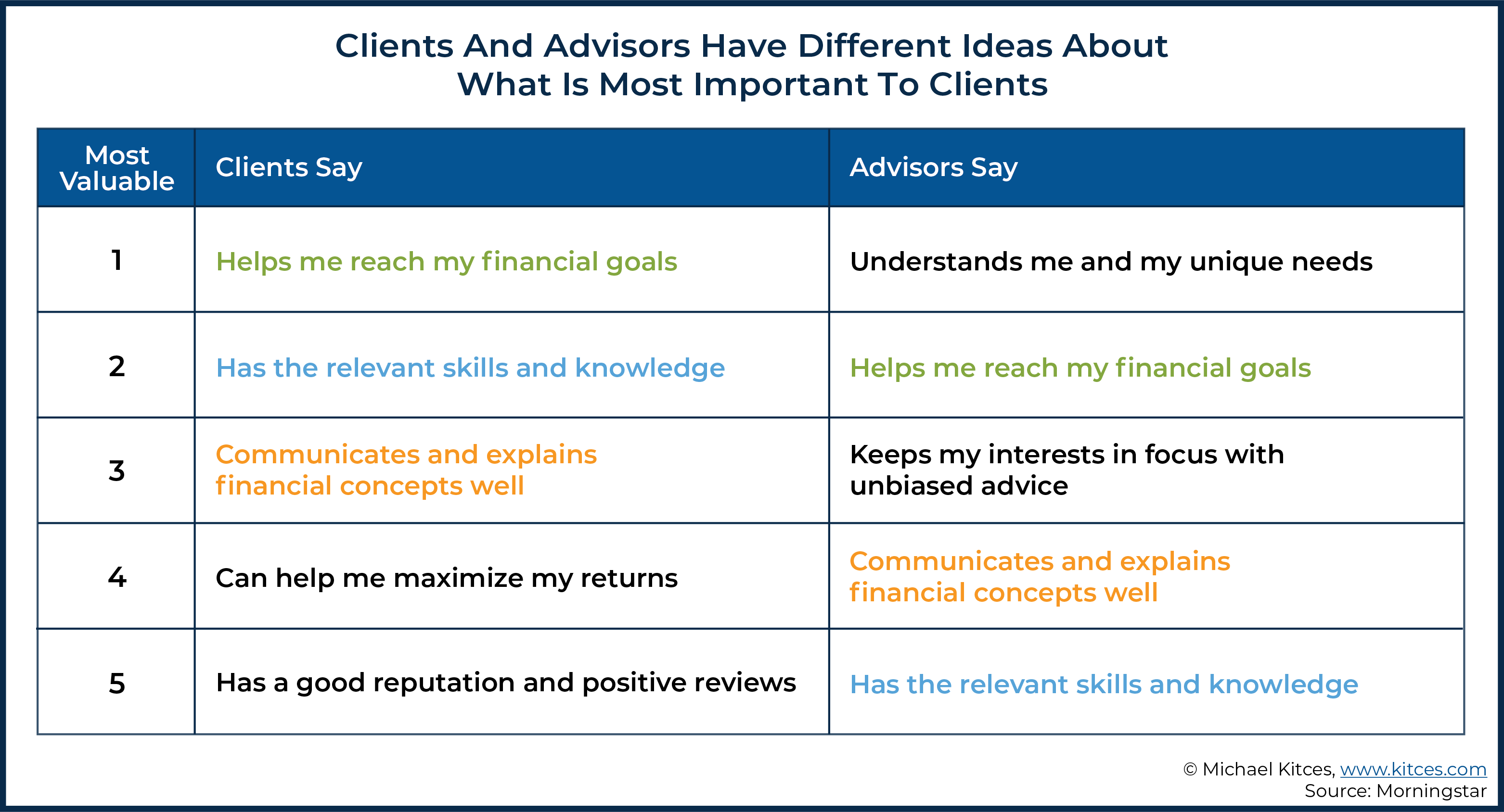

Financial advisors function for the customer, not the company that utilizes them. They ought to be responsive, eager to describe economic principles, and maintain the client's best passion at heart.

An advisor can recommend feasible enhancements to your plan that could help you achieve your objectives better. Lastly, if you don't have the moment or rate of interest to handle your funds, that's one more great reason to employ a monetary consultant. Those are some basic reasons you might need a consultant's expert help.

An excellent economic advisor should not simply market their services, but give you with the official site tools and sources to come to be economically smart and independent, so you can make informed choices on your very own. You want an expert that stays on top of the monetary range and updates in any location and that can answer your financial concerns regarding a myriad of topics.

Little Known Facts About Pkf Advisory Services.

Others, such as licensed financial coordinators(CFPs), currently followed this standard. However even under the DOL regulation, the fiduciary requirement would certainly not have actually related to non-retirement advice. Under the viability requirement, monetary advisors usually service payment for the items they market to clients. This implies the client may never ever obtain a costs from the financial expert.

Charges will certainly additionally vary by place and the advisor's experience. Some advisors may provide lower prices to aid customers that are simply getting going with financial preparation and can not afford a high month-to-month price. Generally, a financial advisor will provide a free, initial assessment. This consultation supplies a chance for both the client and the expert to see if they're an excellent fit for each various other.

A fee-based financial expert is not the exact same as a fee-only financial consultant. A fee-based consultant might gain a visit the website fee for developing a monetary strategy for you, while likewise gaining a payment for selling you a particular insurance item or financial investment. A fee-only economic consultant earns no commissions. The Stocks and Exchange Compensation (SEC) recommended its own fiduciary regulation called Policy Benefit in April 2018.

Our Pkf Advisory Services Statements

At the very same time, the SEC's policy was a lot more all-encompassing because it would certainly not be limited to retired life investments. How Different Kinds Of you can check here Financial Advisors Make Money No Yes Yes No Yes Yes Yes Occasionally No No Yes Yes A digital monetary expert, likewise called a robo-advisor, is a device that some business attend to their clients.

Robo-advisors don't require you to have much money to get started, and they set you back much less than human economic consultants. A robo-advisor can not talk with you regarding the ideal way to obtain out of debt or fund your youngster's education and learning.